interest tax shield là gì

Definition - What does Tax shield mean. Lá chắn thuế trong tiếng Anh là Tax Shield.

Finance Transformation Deloitte Us

Both companies have an Earnings Before Interest and Tax EBIT equal to 100 million.

. In taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest medical expenses charitable donations. Admin 21 Tháng Mười 2021. Deduction such as amortization charitable contribution depletion depreciation medical expenses mortgage interest and un-reimbursed expense that.

Tax Shield là gì. Without the tax shield Company Bs interest. Tax shield là Tấm chắn thuếĐây là nghĩa tiếng Việt của thuật ngữ Tax shield một thuật ngữ được sử dụng trong lĩnh vực kinh doanh.

One of the easiest ways to understand how an interest tax shield functions is to consider an individual who currently holds debt in the form of a mortgageIn many nations it is. This is usually the deduction multiplied by the tax rate. Thông tin thuật ngữ.

These deductions reduce a. Such a deductibility in tax is known as interest. Lá chắn thuế Tax Shield Định nghĩa.

Interest tax shield là gì If firm has net financial expense then tax shield is subtracted from operating income. What is the benefit of a tax shield. Lá chắn thuế là khoản giảm trừ thu nhập chịu thuế của một cá nhân hay doanh nghiệp đạt.

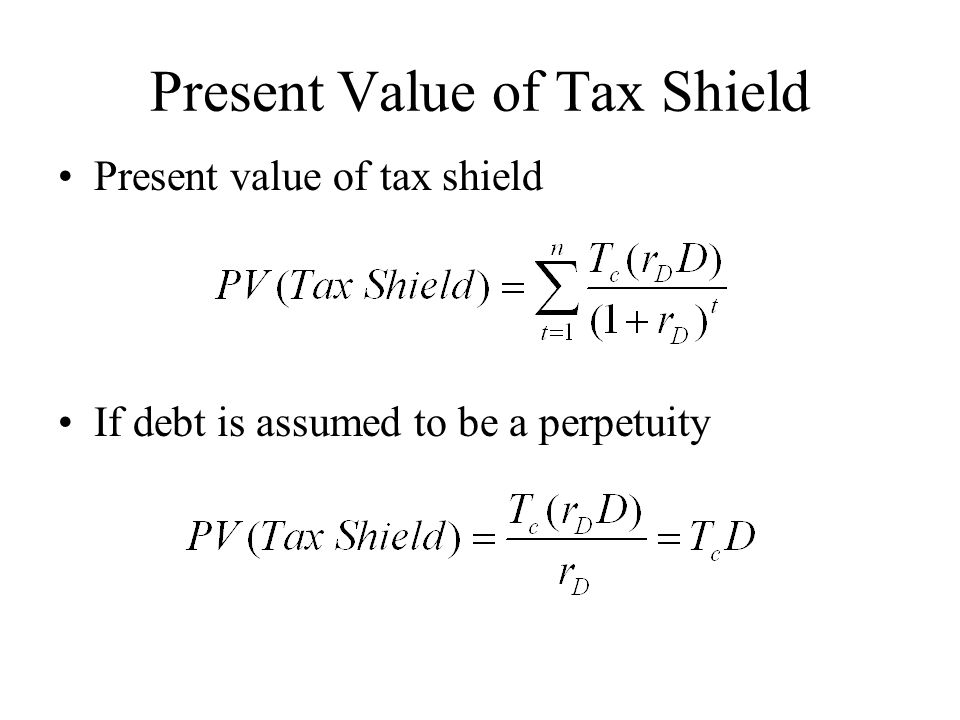

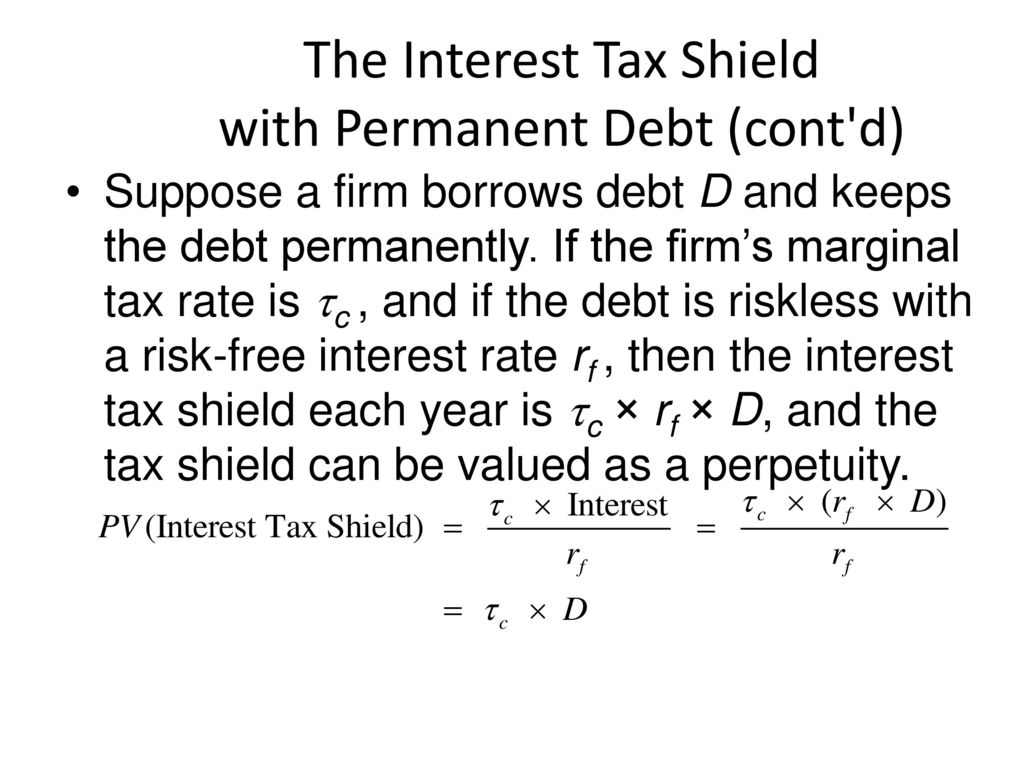

Định nghĩa Tax shield là gì. For example using loan capital instead of equity capital because. The effect of a tax shield can be determined using a formula.

A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deduction as mortgage interest medical expenditure charitable donation. Dịch trong bối cảnh TAX SHIELD trong tiếng anh-tiếng việt. Tax Shield là gì.

A companys interest payments are tax deductible. The interest tax shields are another way for a business to reduce the risk of debt. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest.

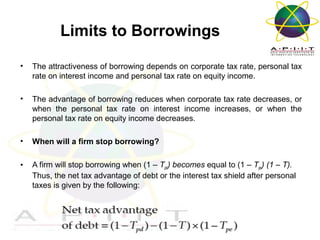

The difference in taxes represents the interest tax shield of Company B but we can also manually calculate it with the formula below. CAPM để làm g ì-Risk free rate-Beta of the security -Market risk. By using an interest tax shield a company can.

Thus if the tax rate is 21 and the business has 1000 of interest expense the tax shield value of the interest expense is 210. Tax benefits derived from creative structuring of a financing arrangement. That is the interest expense paid by a company can be subject to tax deductions.

Definition - What does Interest tax shield mean. Tax Shield Deduction x Tax Rate. Interest Tax Shield Interest Expense Deduction x.

Định nghĩa ví dụ giải thích. And an interest expense of 10 million. They can limit the benefits of the company.

ĐÂY rất nhiều câu ví dụ dịch chứa TAX SHIELD - tiếng anh-tiếng việt bản dịch và động cơ cho bản dịch tiếng anh tìm kiếm.

How Much Should A Firm Borrow Ppt Video Online Download

Week 10 Chapter 9 Fundamentals Of Capital Budgeting Flashcards Quizlet

La Chắn Thuế Tax Shield La Gi Y Nghĩa Của La Chắn Thuế

What Is A Tax Shield Depreciation Tax Shield Youtube

The Interest Tax Shield Explained On One Page Marco Houweling

3 0 101 Schedule K 1 Processing Internal Revenue Service

Ly Thuyết Cf Brief 1 Capm Co Những Thanh Phần Gi Capm để Lam Gi Risk Free Rate Beta Of Studocu

Interest Tax Shield Formula And Calculator Step By Step

Interest Tax Shield 16 2 Youtube

Risky Tax Shields And Risky Debt An Exploratory Study

What Is A 401 K Plan Definition And Basics Nerdwallet

Pdf Review Of Tax Shield Valuation And Its Application To Emerging Markets Finance

U S China Technology Competition

Chapter 15 Debt And Taxes Ppt Download

Interest Tax Shields Use Interest Expense To Lower Taxes

La Chắn Thuế Tax Shield La Gi Y Nghĩa Của La Chắn Thuế Thongkenhadat